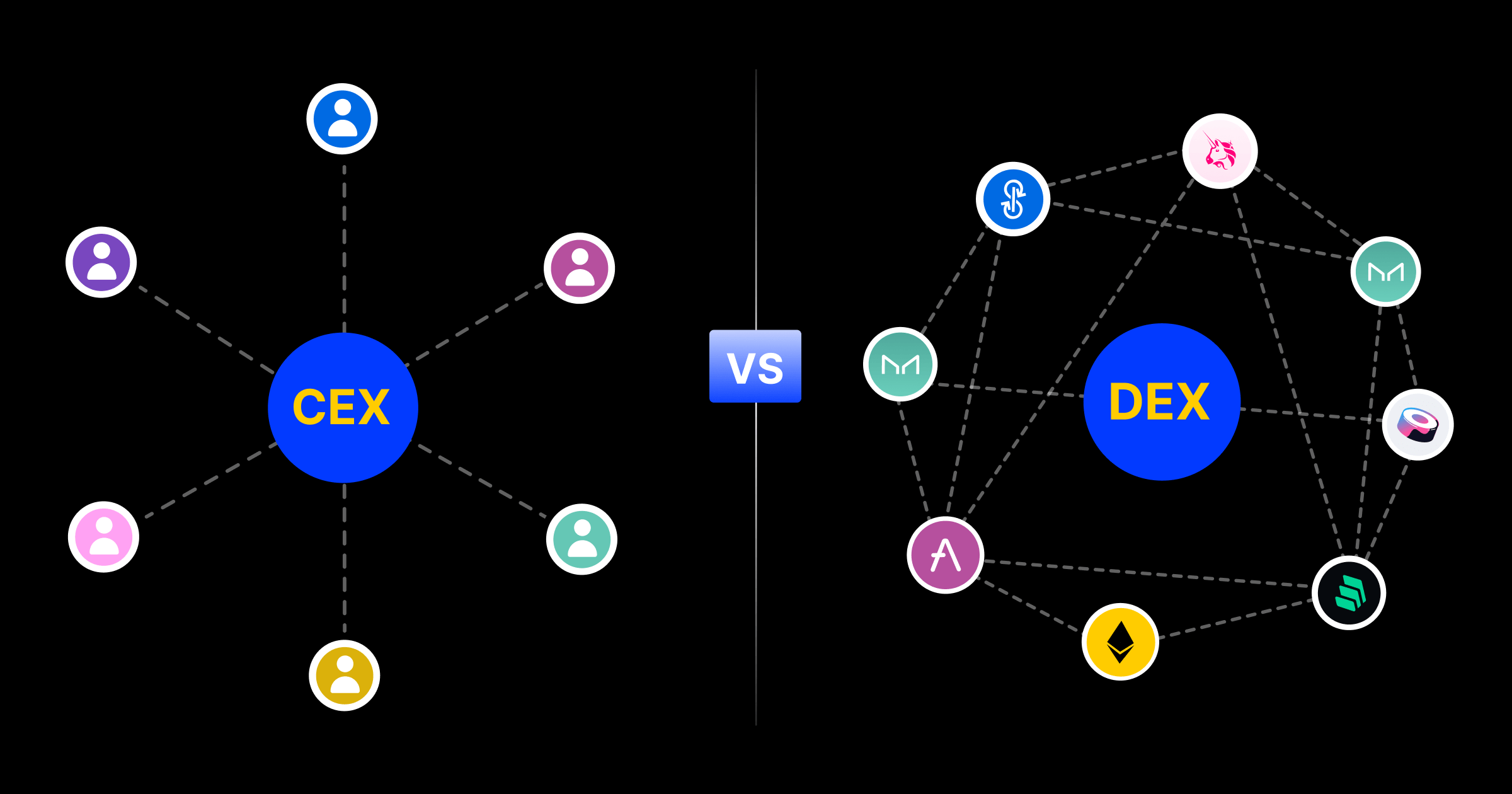

Cryptocurrency exchanges allow people to buy, sell, and trade digital assets like Bitcoin and Ethereum. However, not all exchanges are created equal. The two primary types of crypto exchanges are centralized and decentralized. Each has its pros and cons, so you'll need to determine which model aligns best with your needs and priorities.

What is a Centralized Crypto Exchange?

A centralized exchange is a third-party service that requires you to deposit your funds with them to trade. They hold your digital and/or fiat currencies on your behalf to facilitate trades.

Benefits of Centralized Exchanges:

Easy to use: Centralized exchanges typically offer a simple user interface that makes trading easy for beginners.

Greater liquidity: Centralized exchanges have higher trading volumes, so you'll have an easier time buying and selling coins quickly at a fair price.

More options: Centralized platforms usually list a wider selection of cryptocurrencies as well as pairings between altcoins and fiat currencies.

Advanced trading: Many centralized exchanges offer advanced trade types like margin trading, futures, and options trading.

Drawbacks of Centralized Exchanges:

Security risks: Holding large amounts of customer funds makes these exchanges a prime target for hacking and theft. If an exchange is hacked, you could lose your funds.

Privacy concerns: Centralized exchanges collect and store considerable customer information, raising privacy risks. Your personal data and trade history could be exploited.

Manipulation risks: Higher trading volumes and control of funds also make centralized exchanges more prone to price manipulation by unethical actors.

Legal issues: Stricter regulation of centralized exchanges may require them to implement KYC procedures, collect customer information, and limit access in some countries.

Withdrawal limits: Centralized exchanges control your funds, so they may limit how much you can withdraw or delay withdrawals.

What is a Decentralized Crypto Exchange?

A decentralized exchange allows peer-to-peer cryptocurrency trading without a intermediary service controlling your funds. Instead of depositing crypto with an exchange, trades are directly between users (called makers and takers) through an automated process.

Benefits of Decentralized Exchanges

Improved security: DEXs are non-custodial, meaning you maintain control of your funds at all times. There is no central point of failure, so DEXs are much less likely to be hacked. With centralized exchanges, users must deposit funds with the exchange, creating a honeypot for hackers.

Transparency: All trades are executed on-chain, so they are transparent and auditable. You can verify transactions and view the overall exchange order book in real time. This stands in contrast with centralized exchanges that are opaque black boxes.

Censorship resistance: No single entity controls a DEX or has the ability to block user access. This makes DEXs resistant to censorship and government intervention. Centralized exchanges are at risk of being regulated, shut down, or restricted in certain jurisdictions.

Greater selection: DEXs typically have a wider selection of assets, especially for new or controversial assets that centralized exchanges may avoid listing due to regulatory concerns.

Drawbacks of Decentralized Exchanges

Lower liquidity: DEXs struggle to match the high liquidity of large centralized exchanges. It can be difficult to trade large amounts without substantial slippage, especially for smaller cap assets.

Slower transactions: Executing trades on-chain can result in slower transaction times compared to off-chain settlement used by centralized exchanges. During periods of network congestion, transaction times and fees can spike.

Complicated interfaces: DEX interfaces tend to be more complicated to understand compared to the simple interfaces of centralized exchanges meant for casual users. Trading on a DEX typically requires understanding private keys, wallet setup, and transaction fees.

Price inefficiency: Prices on DEXs tend to be less efficient compared to centralized exchanges. Arbitrage opportunities abound, but can be difficult to execute due to on-chain settlement and low liquidity. Prices on DEXs may deviate substantially from the broader market.

Manipulation risks: It can be more difficult for DEXs to detect and prevent manipulative behaviors like wash trading that can artificially inflate volumes and prices. Reliable volume data is hard to determine when transactions are anonymous and on-chain.

Wrapped tokens: DEXs built on Ethereum rely on wrapped or synthetic versions of assets like BTC, XRP or other non-native blockchain assets. These wrapped tokens can be risky, as you are trusting a third-party to properly back the tokens with the underlying asset. Redeeming them for the asset may be prohibitively expensive or complicated.

The Future of Decentralized Exchanges

DEXs offer an attractive alternative to centralized exchanges but still face significant barriers to mainstream adoption. Some future developments that could help decentralized exchanges achieve more widespread usage include:

· Cross-chain swaps and interoperability allowing DEXs to support more assets

· Layer 2 solutions to address scalability and lower transaction costs

· Automated market makers and liquidity bots improving liquidity

· Simplified UX and onboarding to appeal to non-technical users

· Stronger community governance and transparency standards to build user trust

· Integration with hardware wallets and portfolio trackers for a more seamless experience

Decentralized exchanges have rapidly evolved in a short time and show no signs of slowing down. While still imperfect, DEXs represent an important step toward a future financial system that is open, transparent, and supports a diverse global economy built on blockchain technology. For those motivated by the principles behind crypto, decentralized exchanges may be worth exploring despite their flaws. With time and progress, DEXs can evolve into a compelling alternative to not just crypto exchanges, but traditional stock exchanges as well.

Conclusion

Choose a centralized exchange if you prioritize ease of use, selection, and advanced trading. Opt for a decentralized exchange if security, privacy, and control of your own funds are most important to you. For many traders, a combination of the two types of exchanges according to their needs may provide an ideal solution.